Insurance for Business Employee Benefits

Employee benefits are, perhaps, the most important insurance for business owners intending to retire early, more often. After all, you will need a key person to run things every seven years, right? And, as you hire, wouldn't it be nice to choose from a group of well-qualified and excellent candidates that you know you could trust? And reward? And retain?

Your Company's 401k Plan Fiduciary Liability

If you are responsible for your company's 401k plan, you and the business owners have a serious and potentially liable regulatory and "fiduciary" responsibility to your employees in regard to the prudent performance of their plan. Watch this video to learn how you can avoid a regulatory lawsuit.

The “Late Start” Maximum Deduction Pension Plan

If you are self employed or have your own business - with fewer than 5 employees - and you are at least 50 years of age, watch this short video to discover Section 412(e)3 of the tax code, known as the “Late Start” pension plan for small business owners.

Reduce Payroll Taxes with Flexible Spending Accounts

Enable your employees to pay dependent care and health care expenses with tax exempt income.

Do your employees want dental and vision care?

If you are responsible for your company's employee benefits, and want to substantially enhance your healthcare coverage with benefits your employees want and need, watch this video to learn how inexpensive it is to add dental and vision care to company benefits package.

Tax Free Cash for Employee Healthcare Expenses

Watch this short video to learn why companies of all sizes are adding Cash Indemnity provisions to their Employee Benefits

Income Protection for Employees

If you are responsible for your company's employee benefits, and recognize a moral obligation to provide your employees with a source of income when they are unable to work due to a permanent disability or an extended period of serious illness or injury recovery, watch this short video on long term disability insurance.

Employee Paycheck Protection

More than 70% of American employees live paycheck to paycheck . . . watch this short video to learn low cost short term disability insurance paycheck protection is good for both your employees and your business.

Final Expense Benefit for Employee Families

If you want to give your employees a low cost but highly valued benefit, watch this short video to learn about a much needed but often overlooked component to every company's benefit package.

Supplemental Executive Retirement Plan (SERP)

If you want to recruit, reward, or retain your top people, watch this short video to learn why non-qualified, deferred compensation plans are so popular. Refer to Internal Revenue Code Sections 101 and 7702 for specific guidance.

Tax Exempt Medical Executive Reimbursement Plan

If you compete to recruit top talent . . . watch this short video to learn how an Executive MERP can help.

Executive Bonus Retirement Plan

Are you an owner or executive with any size company? Watch this short video to learn about Sections 162 and 7702 of the Internal Revenue Code, and how to use tax deductible corporate dollars to fund a legally discriminatory and exclusive retirement plan for specific people in your company (including yourself) that can provide tax free income at retirement.

Healthcare Savings Accounts with Major Medical Plans

If you are responsible for your company's benefit package, and you want to enable your employees to pay for deductibles and copayments with tax deductible dollars, watch this video to learn why Health Savings Accounts are so strongly endorsed by the US government.

Special Solo 401(k) for Business Owners Without Full Time Employees

If you work for yourself and have no employees working more than 1000 hours a year . . . watch this short video to discover the extraordinary benefits of a Solo 401(k) Plan.

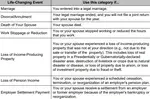

Tax Benefits of Healthcare Reimbursement Accounts

If you are responsible for your company's benefit package, and you want to reduce the cost of your health insurance without reducing benefits, watch this video to learn how Section 105 of the tax code allows you to create Health Reimbursement Accounts for your employees.

Minimize Your Company Healthcare Benefit Expense

If you want to give your employees more healthcare options while reducing both your monthly expense and your administrative obligations, watch this short ICHRA video to learn about an ACA approved alternative to group insurance benefits.

Employee Benefits thru Tax Exempt Payroll Deduction

If you are responsible for your company's employee benefits, and want your employees to share in the cost of their healthcare plans, watch this video to learn how Section 125 of the tax code enables payroll deduction tax exemptions for employee benefits.

Low Cost / Low Risk “Simple” 401k

If you are responsible for the administration of your company's 401k plan, watch this video to learn how important it is to avoid fiduciary liability and protect employee accounts, AND discover a well kept secret provision of the tax code known as a Simple 401k.

Small Business Options for Healthcare Benefits

If you are responsible for your company's healthcare benefits, and you have fewer than 50 employees, watch this video to learn what you need to know in order to be sure that your business and your employees comply with the Affordable Care Act.

Reduce Cost of Healthcare Benefits with Split Funding

If you are responsible for your company's employee benefits, and your employees are as a group relatively young and healthy, watch this video to learn how you can lower the cost of your healthcare coverage with a split funded insurance strategy.

Allow Employees to Select the Benefits They Want

If you are responsible for your company's employee benefits, and have employees asking for additional benefits your company cannot afford to provide, watch this short video to learn how you can offer your employees a selection of additional benefits they can choose to pay for through payroll deduction.